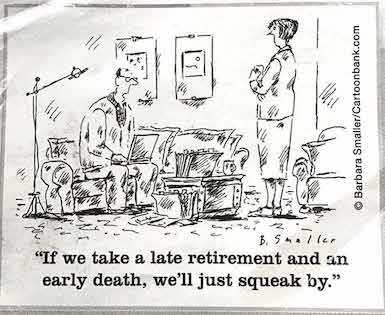

In the “old days,” it was so much easier to predict how much a retiree would need in the bank to comfortably make sure they don’t have “too much life at the end of their money.” People retired and didn’t work part-time or start a business like they do in their 60s and 70s today. People had pensions. It was rare for someone to live past 85 years old.

The old rule of thumb was that you could withdraw 5% of your retirement savings annually to pay for your expenses, but this is where it gets a little scary. The average U.S. citizen in their 60s has $172,000 saved for retirement so that translates to you spending $8,600 annually which means you need to move to the cheapest country in the world, Afghanistan where it costs about half that much annually to live there. Oops, I just found out that retirement experts have dropped that to 4% because of our extra longevity so that means you only have $6,880 in annual spending available to you. But, consider this: half of Americans 55-66 have absolutely no retirement savings, so it doesn’t matter whether it’s 4% or 5% in that scenario. Ouch!

JP Morgan just changed their internal guidance to their financial advisors to recommend that they tell their clients that they need to plan as if they’re going to live until 100 years old.

Policymakers, we have a problem!

People are living longer and have less money saved (just 20% of us have a pension we earned while we were working). Caregiving costs will grow as we live longer. This all foretells a frightening future unless there’s a major sociological shift ahead: a much larger percentage of us move in with our children as we get older. This trend is starting to happen and accelerated with the pandemic.

I have two data points that suggest how many older people are solving for this.

When I was in charge of all Airbnb hosts globally, I was fascinated that the fastest growing demographic of hosts globally was people 50 and older (and the highest rated hosts for guest satisfaction were women 60+), so becoming an Airbnb host may be the modern day version of earning a pension.

Secondly, in my 6 years of living in Baja, I’ve been intrigued by how many retired Americans have chosen to downsize their spending by moving to Mexico. This isn’t a new phenomenon but with better Wifi, improving health care services, and plentiful flights to the U.S., it’s another way people are learning to stretch their dollar….or peso.